Asking for a Raise Template (MadLibs Style)

About a year after undergrad/getting my first real job, I emailed my bosses and asked for a raise. I asked for a 33% raise and ended up with a 25% raise.

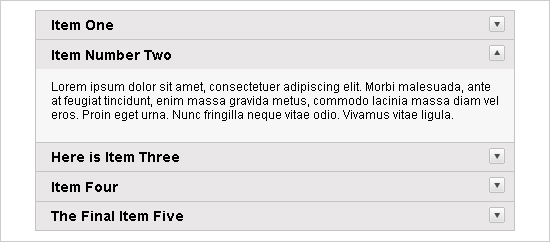

jQuery Accordion Open Automatically

Working with jQuery Accordions I ran into two issues that seemed to be simple but turned out to be a hassle since answers were all over the place from using Python to C++ to it can’t be done.

I’ve Always Been Afraid to Break the Rules

Then I thought, what’s it like not to be afraid? What’s it like to freely question authority?

Google Apps/Gmail GoDaddy Connection Refused Error in WordPress

How I got my GoDaddy hosted website to work with Wordpress plugin Contact Form 7 with email hosted on Google.

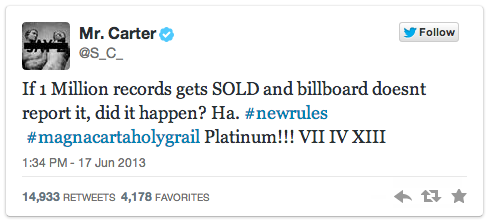

How an Album Goes Platinum Before It Goes On Sale: How to Market Media in the 2010s

The album would be available for free but only to the first one million Samsung Galaxy phone users, via a Jay Z branded app.

Are The Grammys Still Relevant?

Are the Grammys only as significant as the live performances, thus pushing the actual winners list to afterthought rather than purpose?

The Rise and Demise of America Online

In 2000, approaching the height of the .com bubble, AOL bought Time Warner for $165 Billion dollars. Unfortunately, less than 3 years later AOL experienced its first decline in quarterly sales in its history.

Nielsen SoundScans

Back in the record label hay day, the highest one-week album tally recorded during the Soundscan era was 900% higher at 45.4 million albums, in late December 2000.